Earnings Takeaway: Microsoft 9/30/23 Results (FY24-Q1)

This post is centered around Microsoft’s Azure business from the perspective of the broader cloud spend environment.

Takeaway

MSFT reported FY24-Q1 (ended 9/30/23) results Tuesday (10/24) after the close and shares closed 3.1% higher on Wednesday while GOOGL plunged 9.5%…ouch (the rebound in long-term treasury yields didn’t help).

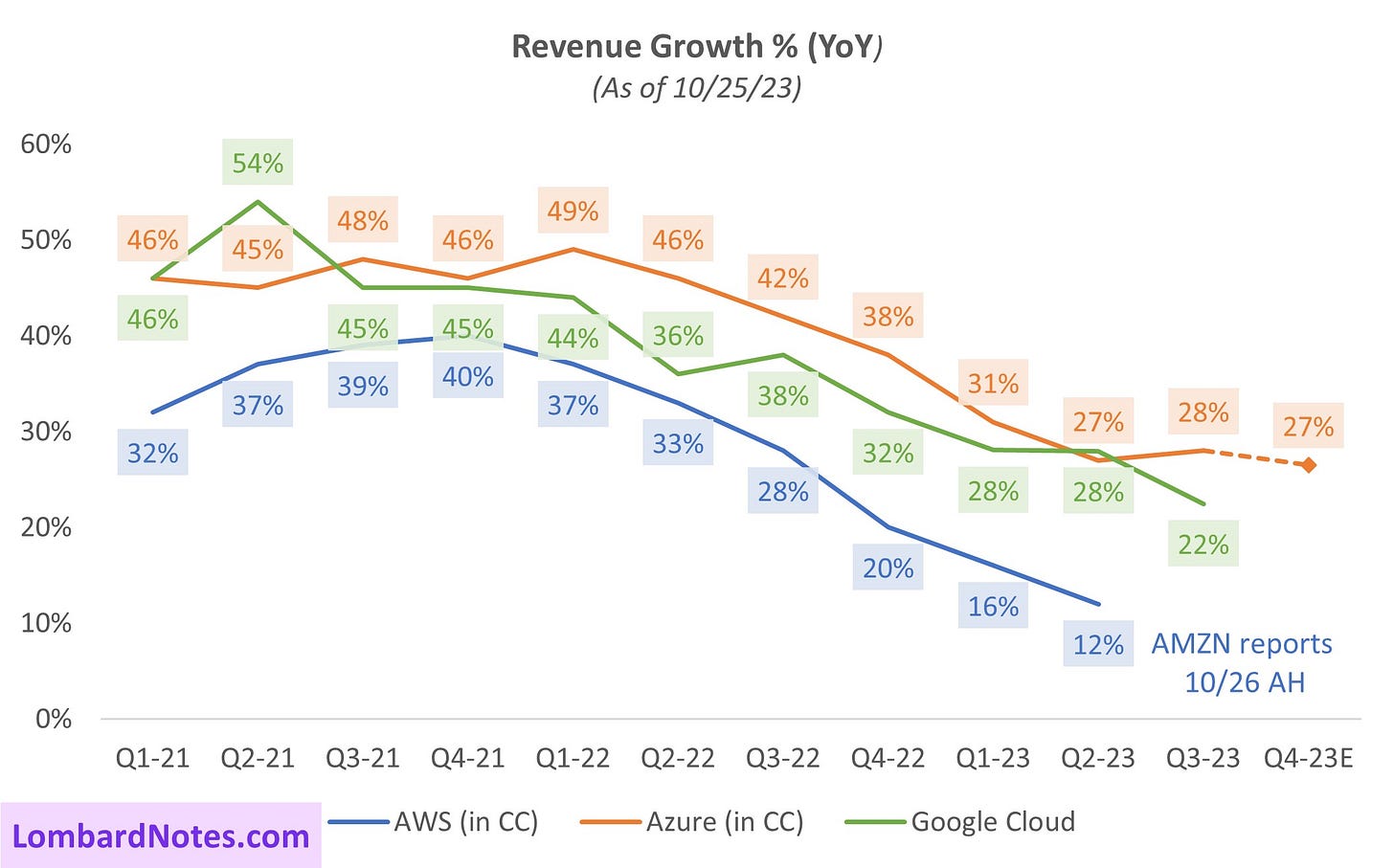

We are seeing growth in the Azure business stabilize around the 26-28% (in CC) range this quarter and over the next two quarters as well. The optimization narrative has not changed; however, market share gains (likely from AWS) and demand for AI services have and will likely continue to buoy growth in the coming quarters. We will have to wait and see for signs if/when broader demand will reaccelerate.

Azure revenue grew 28% YoY (in CC), ahead of the 25-26% (in CC) the company guided last quarter. The better-than-expected performance was attributed to demand for AI services (+3 points) which drove an “increase GPU capacity and better-than-expected GPU utilization”. Put another way, excluding the lift from AI demand, growth in the Azure business would have slowed a percentage point from the prior quarter.

Looking ahead to the next quarter, Azure revenue is expected to grow 26-27% (in CC), a slight deceleration from the Sep 2023 quarter with AI contribution as the bright spot. For the March and June 2024 quarters, management’s current view is growth rates will be stable vs. the Sept 2023 quarter with the same optimization, new workload, and AI trends continuing.

With the market’s sour view on Alphabet’s results, all eyes will be on Amazon’s report on Thursday after the close.

Noteworthy Management Commentary

“Azure again took share as organizations bring their workloads to our cloud.”

-Satya Nadella, CEO

“Azure AI provides access to best-in-class frontier models from OpenAI and open source models, including our own as well as from Meta and Hugging Face, which customers can use to build their own AI apps while meeting specific cost, latency, and performance needs.”

-Satya Nadella, CEO

“Azure and other cloud services revenue grew 29% and 28% in constant currency, including roughly 3 points from AI services. While the trends from prior quarter continued, growth was ahead of expectations primarily driven by increased GPU capacity and better-than-expected GPU utilization of our AI services, as well as slightly higher-than-expected growth in our per-user business.”

-Amy Hood, CFO

“In Azure, we expect revenue growth to be 26% to 27% in constant currency with increasing contribution from AI. Growth continues to be driven by Azure consumption business and we expect the trends from Q1 to continue into Q2.”

-Amy Hood, CFO

“For H2, assuming the optimization and new workload trends continue and with the growing contribution from AI, we expect Azure revenue growth in constant currency to remain roughly stable compared to Q2.”

-Amy Hood, CFO

“Second thing, of course, is the workload start, then workloads get optimized, and then new workloads start and that cycle continues. We’ll lap some of those optimization cycles that were fairly extreme, perhaps in the second half of our fiscal.”

-Satya Nadella, CEO

“We’ve been very consistent that the optimization trends have been consistent for us through a couple of quarters now. Customers, are they going to continue to do that? It’s an important part of running workloads. That is not new. There, obviously, were some quarters where it was more accelerated, but that is a pattern that is and has been a fundamental part of having customers both make new room for new workload adoption and continue to build new capabilities.

And so, I think that impact remains through the rest of the year, and my view is unchanged on that.

And then, of course, I think the key component has always been new workloads start. And at the scale we’re talking about, being able to have stability in our Azure business does mean that we will have a lot of new workload starts. And primarily, we’re expecting those to come from AI workloads, but AI workloads don’t just use our AI services. They use data services, and they use other things.

And so, that combination, I think, looking on a competitive basis, we feel good about our execution. We feel good about taking share, and we feel good about consistent trends. And so, I feel good about that guide and what it says about where we are on share.”

-Amy Hood, CFO